PREVIOUS

Union Budget 2024-2025

(இதன் தமிழ் வடிவத்திற்கு இங்கே சொடுக்கவும்)

Introduction:

- The Union Budget 2024-2025, presented by Finance Minister Nirmala Sitharaman, sets a visionary path for India's economic development with a focus on "Next Generation Reforms."

- It aims to bolster economic growth, improve productivity, and enhance market efficiency.

- Key reforms span various sectors, emphasizing collaboration between the Centre and states.

- The budget promotes competitive federalism and seeks to achieve sustained economic progress.

Key Focus Areas

- The 2024-25 Budget focuses on four main groups: 'Garib' (Poor), 'Yuva' (Youth), 'Annadata' (Farmer), and 'Nari' (Women).

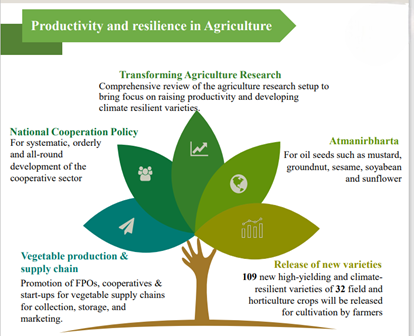

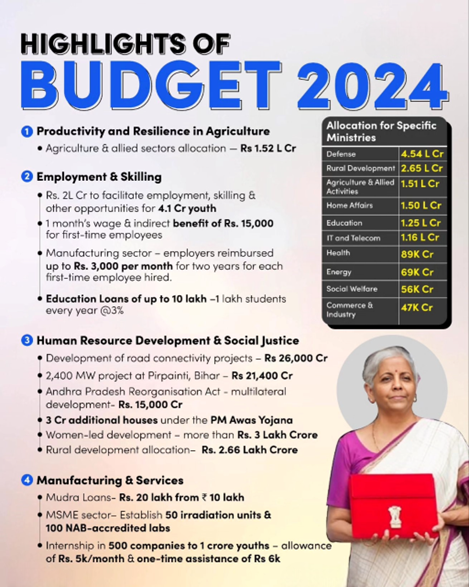

- Additionally, it emphasizes crucial areas: productivity and resilience in agriculture, employment and skilling, inclusive human resource development and social justice, manufacturing and services, urban development, energy security, infrastructure, innovation, R&D, and next-gen reforms.

1. Agriculture

- Total Allocation: ₹1.52 Lakh Crore for agriculture and allied sectors.

New Initiatives

- High-yielding Varieties: Introduction of 109 high-yielding and climate-resilient varieties of 32 field and horticulture crops.

- Natural Farming: Initiating 1 crore farmers into natural farming over the next two years, with the establishment of 10,000 need-based Bio-input research centers.

- Digital Public Infrastructure (DPI): Implementation of DPI for Agriculture in collaboration with states within three years, enabling Jan Samarth-based Kisan Credit cards in five states.

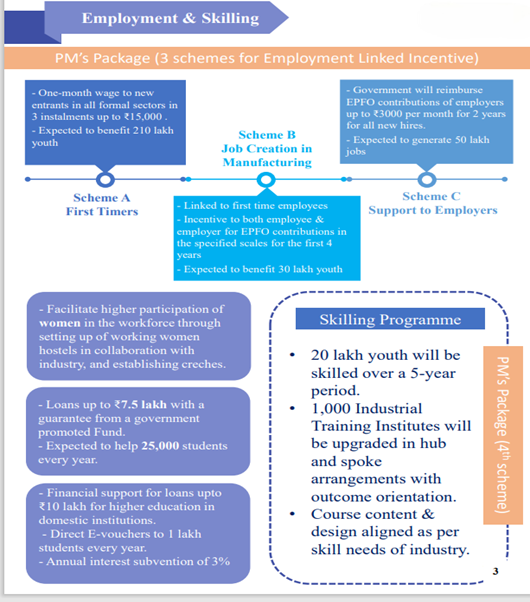

2. Employment and Skilling

- Total Allocation: ₹1.48 lakh crore for education, employment, and skill development.

- Employment Schemes: Introduction of five schemes benefiting 4.1 crore youth with an outlay of ₹2 lakh crore.

Key Schemes

- Scheme A: Direct benefit transfer of one month’s salary for first-time job seekers, expected to benefit 210 lakh youths.

- Scheme B: Job creation in manufacturing, expected to benefit 30 lakh youths.

- Scheme C: Employer-focused scheme covering additional employees across sectors, incentivizing the employment of 50 lakh persons.

- Centrally Sponsored Skilling Scheme: Collaboration with states and industries to skill 20 lakh youth over five years.

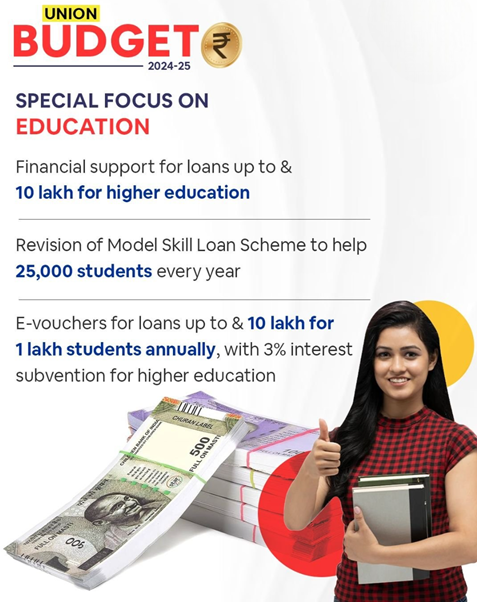

Education

- Higher Education Loans: Education loans of ₹10 lakh for higher education, with annual interest subvention of 3% for one lakh students.

- Upgradation of ITIs: Upgradation of 1,000 Industrial Training Institutes and revision of the model skill loan scheme to facilitate loans up to ₹7.5 lakh, benefiting 25,000 students annually.

3. Human Resource Development and Social Justice

Purvodaya

- Eastern Region Development: Comprehensive development plan will be covering Bihar, Jharkhand, West Bengal, Odisha, and Andhra Pradesh, focusing on human resource development, infrastructure, and economic opportunities.

- Amritsar Kolkata Industrial Corridor: Support for the development of an industrial node at Gaya and various road connectivity projects with a total cost of ₹26,000 crore.

Andhra Pradesh Reorganization Act

- Special Financial Support: ₹15,000 crore arranged for the current financial year, with additional funds in future years.

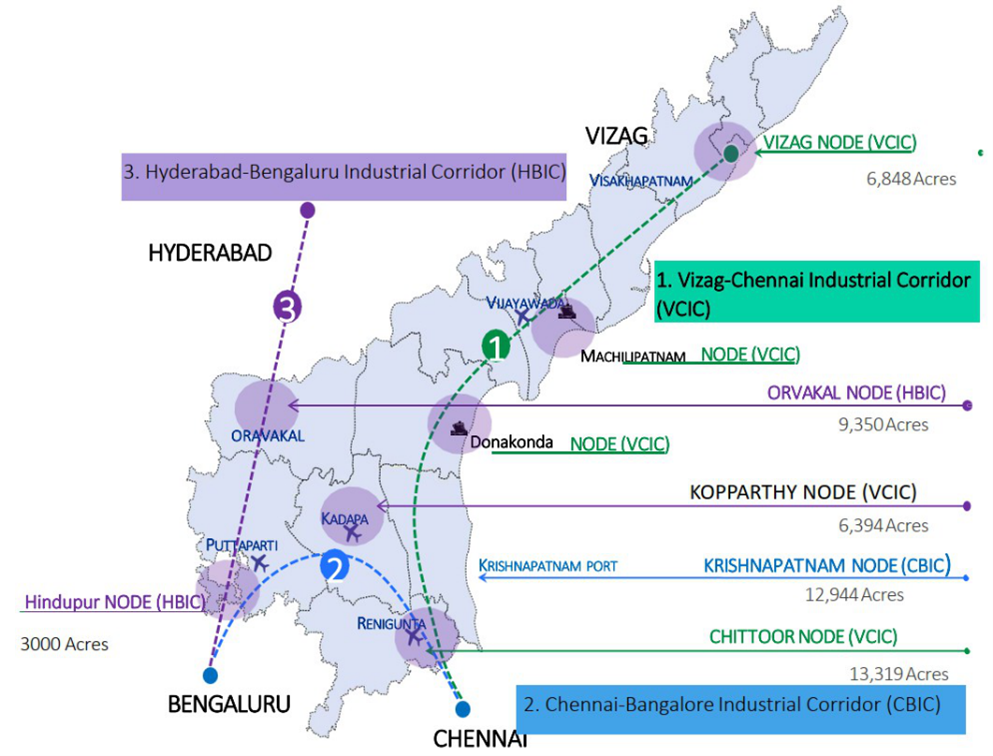

- Commitment to the early completion of the Polavaram Irrigation Project and essential infrastructure development in the Vishakhapatnam-Chennai and Hyderabad-Bengaluru Industrial Corridors.

Pradhan Mantri Janjatiya Unnat Gram Abhiyan

- Tribal Development: Improving the socio-economic condition of tribal communities in tribal-majority villages and aspirational districts.

4. Manufacturing and Services

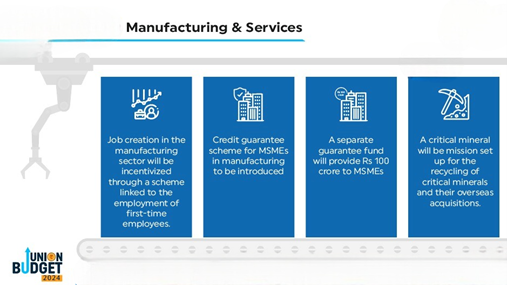

MSMEs

- Comprehensive Package: Financing, regulatory changes, and technology support for MSMEs.

- Credit Guarantee Scheme: Guarantee cover up to ₹100 crore for MSMEs in the manufacturing sector.

- Mudra Loans: Enhanced limit to ₹20 lakh from the current ₹10 lakh.

- TReDS Platform: Reduction of the turnover threshold for mandatory onboarding from ₹500 crore to ₹250 crore.

- E-Commerce Export Hubs: Set up in public-private partnership mode to enable MSMEs and traditional artisans to sell internationally.

Promotion of Manufacturing & Services

- Internships: One crore youth to receive internships in 500 top companies over five years.

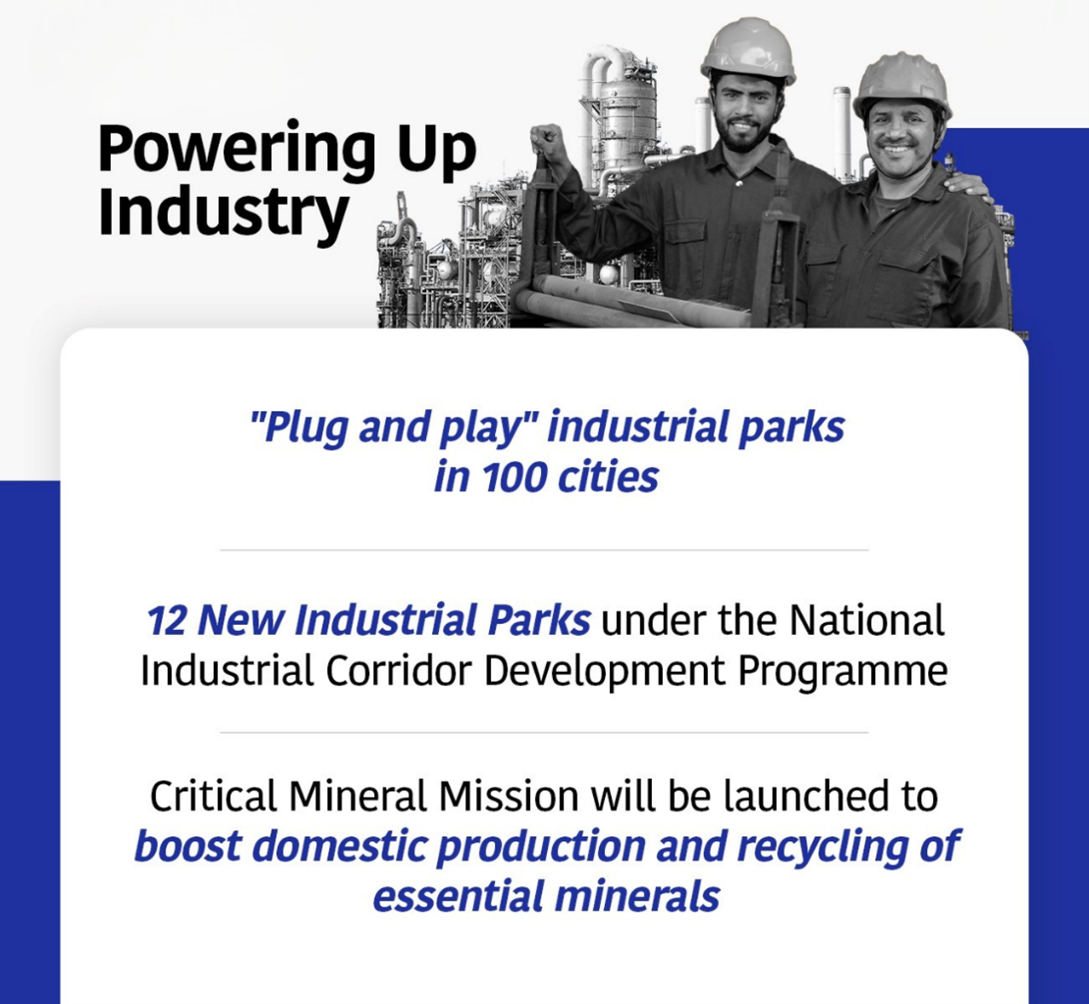

- Industrial Parks: Development of "plug and play" industrial parks with complete infrastructure near 100 cities.

- Critical Mineral Mission: Domestic production, recycling, and overseas acquisition of critical mineral assets.

5. Urban Development

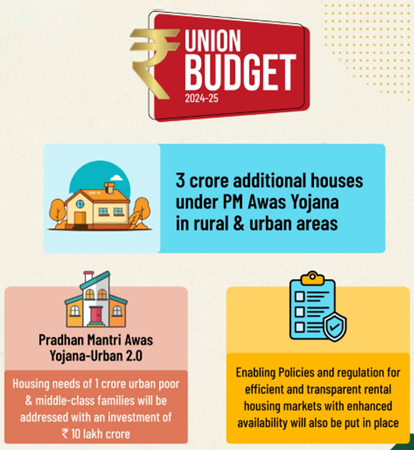

PM-AWAS Yojana Urban 2.0

- Housing for Urban Poor: Aiming to fulfil the housing requirements of 1 crore urban poor and middle-class families through an investment of ₹10 lakh crore, with central aid of ₹2.2 lakh crore over five years.

- Interest Subsidies: Promotion of loans at affordable rates through interest subsidies.

Water Supply and Sanitation

- Collaboration with States: Promotion of water supply, sewage treatment, and solid waste management projects for 100 major cities.

- Use of Treated Water: Initiatives to use treated water for irrigation and filling tanks in surrounding localities.

Street Markets

- PM SVANidhi Scheme Expansion: Establishment of 100 weekly haats or street food hubs over five years.

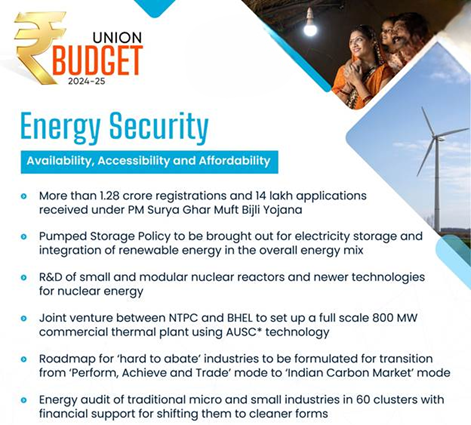

Nuclear Energy

- R&D Initiatives: Research and development of small and modular nuclear reactors in partnership with the private sector, including Bharat Small Reactors and Bharat Small Modular Reactor.

- Solar Power Initiative: PM Surya Ghar Muft Bijli Yojana

- Following the interim budget announcement, the PM Surya Ghar Muft Bijli Yojana has commenced the installation of rooftop solar plants.

- This initiative aims to provide free electricity up to 300 units per month to 1 crore homes.

Advanced Ultra Super Critical Thermal Power Plants

- Development: NTPC and BHEL have jointly developed indigenous technology for Advanced Ultra Super Critical (AUSC) thermal power plants, resulting in a full-scale 800 MW commercial plant.

- Economic Benefits: The development of indigenous capabilities for producing high-grade steel and advanced metallurgy materials for these plants will offer substantial economic advantages.

Support for Traditional Micro and Small Enterprises

- Energy Audits: Investment-grade energy audits will be conducted for traditional micro and small enterprises, such as those in the brass and ceramic sectors.

- Financial Assistance: Financial support will be provided to help these enterprises transition to cleaner energy sources and implement energy efficiency measures.

- The strategy will be extended to an additional 100 clusters in the next phase.

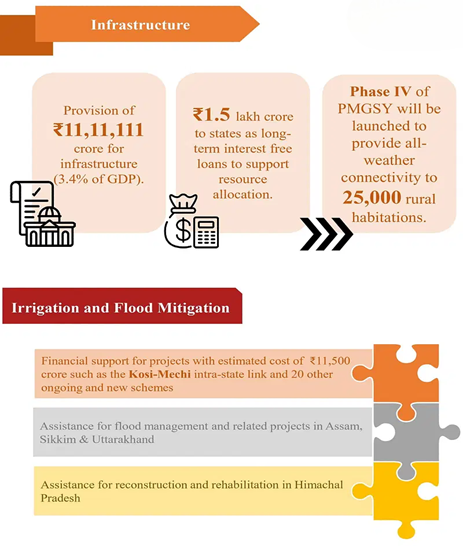

Infrastructure Development

- Capital Expenditure: The government has allocated ₹11,11,111 crore for capital expenditure, amounting to 3.4% of GDP.

- Rural Roads: Phase IV of the Pradhan Mantri Gram Sadak Yojana (PMGSY) will be launched to ensure all-weather connectivity for 25,000 rural habitations.

- Irrigation and Flood Control: Financial support, estimated at ₹11,500 crore, will be provided for projects like the Kosi-Mechi intra-state link and 20 other ongoing and new schemes through the Accelerated Irrigation Benefit Programme and other sources.

- Tourism Development: The Vishnupad Temple at Gaya and Mahabodhi Temple at Bodh Gaya in Bihar will be developed similar to the Kashi Vishwanath Temple Corridor.

- Comprehensive development plans for Rajgir and Nalanda in Bihar will be prepared, along with assistance for developing key destinations in Odisha.

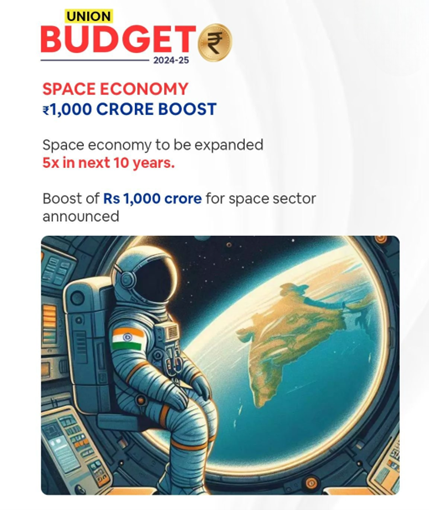

8. Innovation and Research & Development

- Basic Research and Prototype: Launch of the Anusandhan National Research Fund to support basic research and prototype development.

- Space Economy: Establishment of a ₹1000 crore venture capital fund aimed at expanding the space economy by 5 times over the next 10 years.

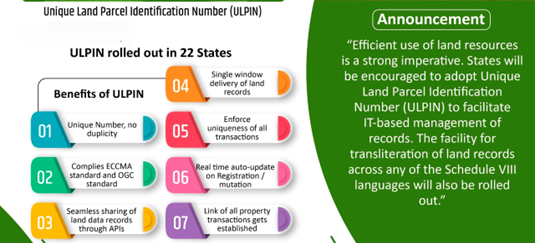

9. Next Generation Reforms

Rural & Urban Land Reforms

- Unique Land Parcel Identification Number (ULPIN): Introduction of ULPIN or Bhu-Aadhaar for all land parcels.

Labour-Related Reforms

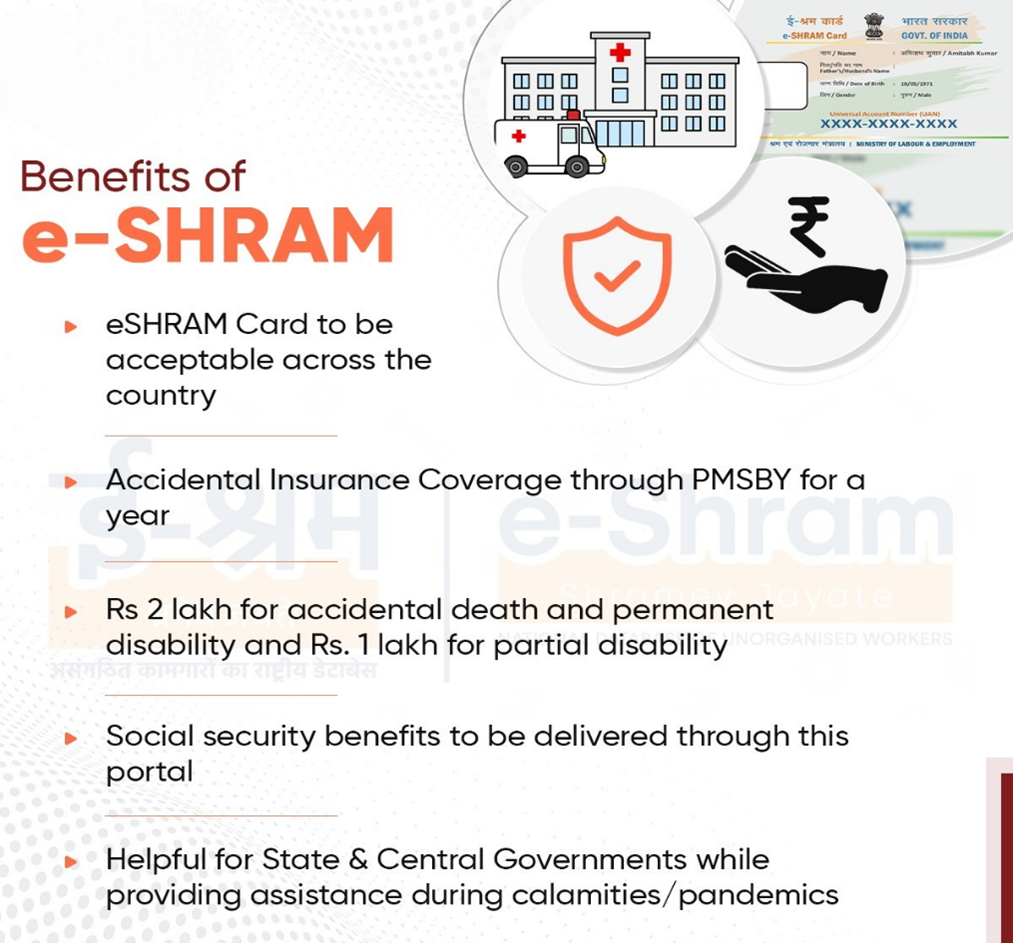

- Integration of E-Shram Portal: Comprehensive integration with other portals to create a one-stop solution.

- Revamping Shram Suvidha and Samadhan Portals: Enhancing these portals to simplify compliance for industries and trade.

Taxonomy for Climate Finance

- Development of Taxonomy: Creation of a taxonomy to improve the availability of capital for climate adaptation and mitigation efforts.

Foreign Direct Investment and Overseas Investment

- Simplified Rules: Streamlining rules and regulations to facilitate FDI.

- Prioritization: Encouraging prioritization in investments.

- Promotion of Indian Rupee: Expanding opportunities to use the Indian Rupee for overseas investments.

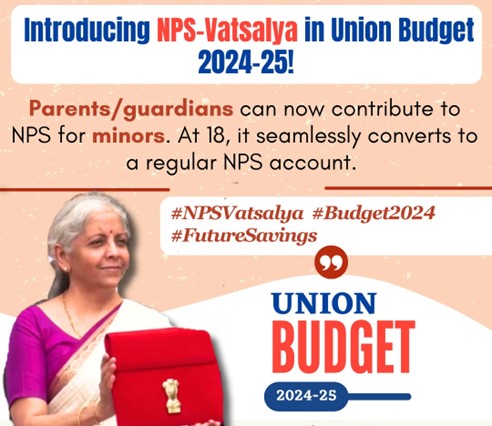

NPS Vatsalya

- Contribution Plan: Introduction of a scheme allowing parents and guardians to contribute for minors, which can be seamlessly converted into a normal NPS account upon the minor reaching adulthood.

Ease of Doing Business

- Jan Vishwas Bill 2.0: The government is working on this bill to further simplify and enhance the ease of doing business.

- States will be incentivized to implement their Business Reforms Action Plans and promote digitalization.

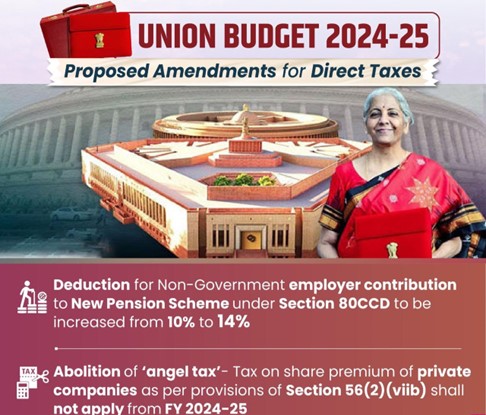

New Pension Scheme (NPS)

- NPS Review: The Committee will be reviewing whether the NPS has made significant progress.

- A solution is being developed to address key issues while maintaining fiscal prudence, aiming to protect the interests of common citizens.

10. Tax-Related Proposals

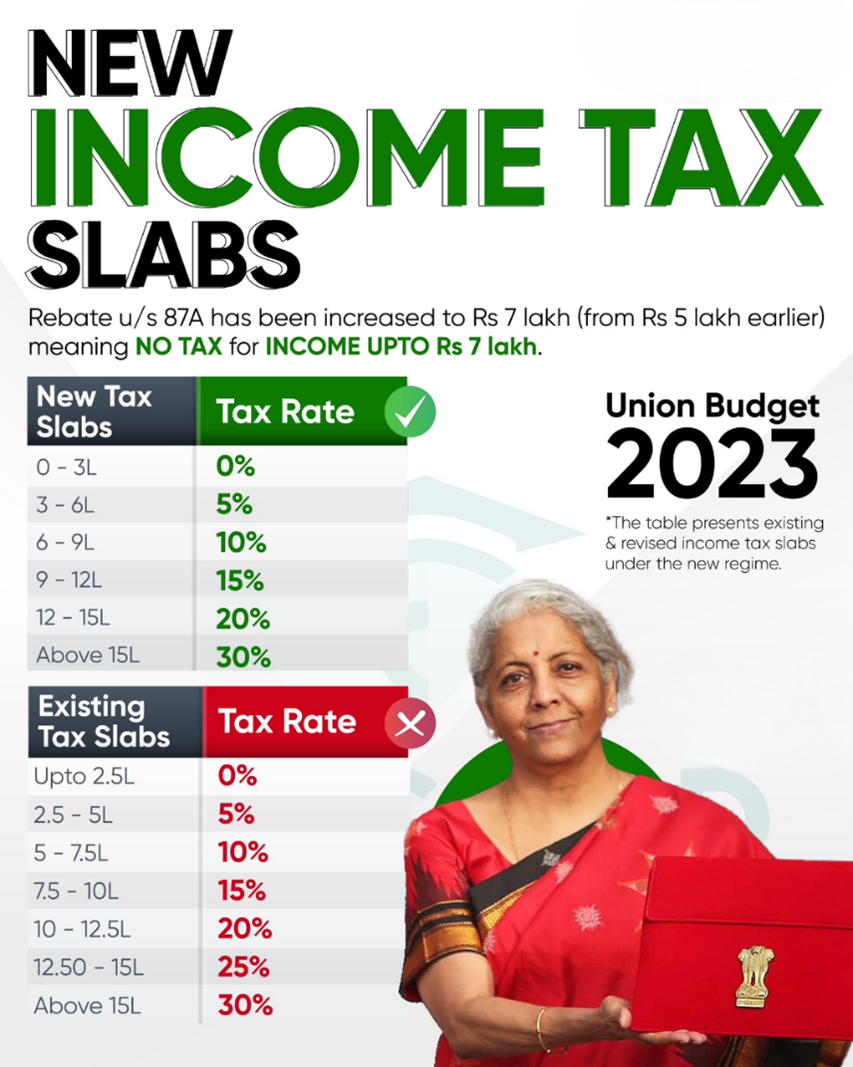

Simplification of New Tax Regime

- The tax rate structure in the new tax regime for 2024 has been revised to provide clearer details and improved benefits for taxpayers.

- The revised tax slabs are:

- Up to ₹3 lakh: Nil

- Between ₹3 lakh and ₹7 lakh: 5%

- Between ₹7 lakh and ₹10 lakh: 10%

- Between ₹10 lakh and ₹12 lakh: 15%

- Between ₹12 lakh and ₹15 lakh: 20%

- Income above ₹15 lakh: 30%

- Additionally, the Standard Deduction has been enhanced to ₹75,000.

- These changes are expected to ensure that taxpayers can save up to ₹17,500 more under the new tax regime.

- The revised slabs and increased standard deduction aim to make the tax process simpler and more beneficial for individuals.

Comprehensive Review of Income Tax Act, 1961

- Purpose: A comprehensive review of the Income Tax Act, 1961, is aimed at making the legislation more concise, lucid, and accessible.

- This initiative is expected to reduce disputes and litigation, providing greater tax certainty to taxpayers.

- Timeline: The review is projected to be completed within six months.

- Initial Steps: The Finance Bill will begin by simplifying aspects of the tax regime.

- Charities: Changes to tax treatment of charitable organizations.

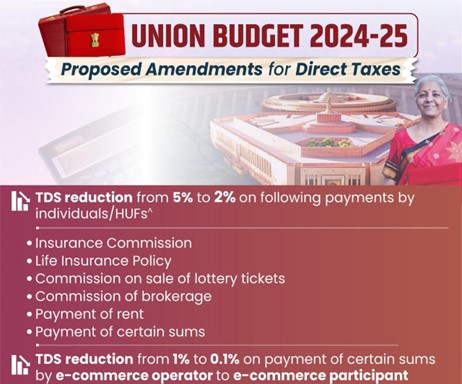

- TDS Rate Structure: Revisions to the Tax Deducted at Source (TDS) rates.

- Reassessment and Search Provisions: Streamlining reassessment and search procedures.

- Capital Gains Taxation: Modifications to the taxation of capital gains.

Angel Tax Abolished

- Abolition: The government has abolished the angel tax, which was imposed on investments by startups.

- This move is intended to encourage investment in startups and foster growth in the sector.

- Background:

- Angel tax was introduced in 2012 to prevent the use of unaccounted money through high-value share subscriptions in closely held companies.

- Expansion: Its scope was broadened in the 2023 Union Budget to include non-resident investors, leading to significant opposition from startups.

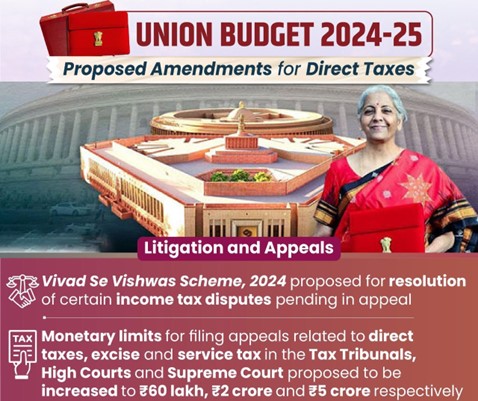

Litigation and Appeals

Government Initiatives:

- Backlog Reduction: Plans to deploy additional officers to expedite the resolution of first appeals, particularly those with significant tax implications.

- Vivad Se Vishwas Scheme, 2024: A proposed scheme to resolve income tax disputes pending in appeal.

- Safe Harbour Rules: Expanding and making safe harbour rules more attractive to reduce international tax litigation and provide certainty.

Deepening the Tax Base

Proposals:

- Security Transactions Tax (STT): Increase in STT on futures and options to 0.02% and 0.1%, respectively, to broaden the tax base.

11. Other Major Proposals

- Equalization Levy: Withdrawal of the 2% equalization levy.

- IFSC Tax Benefits: Expansion of tax benefits for specific funds and entities in International Financial Services Centres (IFSCs).

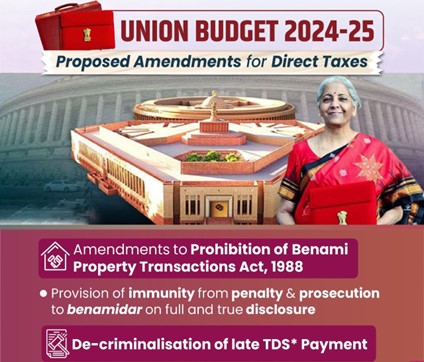

- Benami Transactions Act: Immunity from penalty and prosecution for benamidars who make a full and true disclosure, aiming to enhance convictions under the Benami Transactions (Prohibition) Act, 1988.

- Custom Duty Changes: Various modifications to custom duties.

- Capital Gains Taxation: Simplification and rationalization of capital gains taxation.