PREVIOUS

Reclassification of FPI and FDI

November 16 , 2024

18 hrs 0 min

5

0

- RBI has finalised a framework to allow foreign portfolio investors to convert their investments to foreign direct investment (FDI).

- Any Foreign Portfolio Investors (FPIs) whose investments would be reclassified as Foreign Direct Investment (FDI) the moment it breaches the 10% stake threshold in an Indian company.

- This is issued under the Foreign Exchange Management (Non-debt Instruments) Rules, 2019.

- Currently, an investment made by foreign portfolio investor along with its investor group (FPI) should be less than 10 per cent of the total paid-up equity capital on a fully diluted basis.

- As per the framework, the FPI concerned will have to take necessary approvals from the government and concurrence of the Indian investee company concerned.

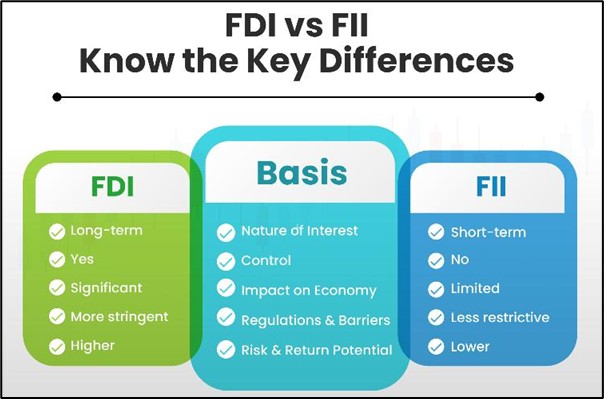

- FDI is the investment through capital instruments by a person resident outside India.

- FPI is an Indirect investment in financial assets like stocks and bonds.

Leave a Reply

Your Comment is awaiting moderation.