PREVIOUS

SDG Goal wise programs of India – Part 02

SDG Goal wise programs of India – Part 02

(இதன் தமிழ் வடிவத்திற்கு இங்கே சொடுக்கவும்)

Deendayal Antyodaya Yojana - National Urban Livelihood Mission (DAY-NULM)

Launched:

- September 23, 2013.

Ministry or Nodal Agency:

- Ministry of Housing and Urban Affairs, Government of India.

Mission and Objectives

- The National Urban Livelihood Mission (NULM), also known as Deendayal Antyodaya Yojana – National Urban Livelihood Mission (DAY-NULM), is a mission-oriented initiative launched by the Government of India to reduce poverty and vulnerability among urban poor households.

- The mission's primary focus is to provide self-employment and skilled-wage employment opportunities, enhancing the livelihoods of the urban poor.

Its key objectives include:

- Empowering the Urban Poor: The mission aims to improve the livelihoods of urban poor, especially those in vulnerable and marginalized groups, by providing skill development, self-employment opportunities, and access to stable income sources.

- Support for Street Vendors: It addresses the livelihood challenges of urban street vendors, ensuring they have access to suitable vending spaces, institutional finance, and social security benefits.

- Social Security: Ensuring access to housing, healthcare, and education for the urban poor.

- Creating Economic Inclusion: Providing opportunities for the urban poor to engage in the mainstream economy through skill development and entrepreneurship.

Target Beneficiaries

- Homeless Individuals: People living on the streets without permanent shelters.

- Street Vendors: Informal workers selling goods and services in public spaces.

- Urban Poor: Low-income households in cities and towns who need support in improving their economic status.

Eligibility Criteria

The target groups for the mission include:

- Homeless Individuals: People without permanent housing in urban areas.

- Street Vendors: Informal sellers who rely on the streets for their livelihoods.

- Urban Poor Households: People living in urban areas, primarily from disadvantaged groups, including SCs, STs, women, minorities, and persons with disabilities.

Key Features and Benefits

Financial Support:

- Self-Help Groups (SHGs): Urban poor SHGs can access low-interest loans (7% annually), with an additional 3% interest subvention for women-led groups, reducing the effective rate to 4%.

- Self-Employment Support: Individuals and groups wishing to start micro-enterprises can access loans of up to ₹2 lakh (for individual ventures) or ₹10 lakh (for group ventures).

- Assistance for Street Vendors: Financial assistance for establishing vending zones, credit access, skills training, and micro-enterprise development.

Non-Financial Support:

- Street Vendors: Development of vending zones with essential infrastructure (water supply, roads, lighting, waste disposal) to improve the working conditions for vendors.

- Shelter for Urban Homeless: Assistance to Urban Local Bodies (ULBs) for constructing, operating, and managing permanent shelters equipped with essential services for homeless individuals.

- Skill Development: Extensive training programs to enhance employability or help start new businesses.

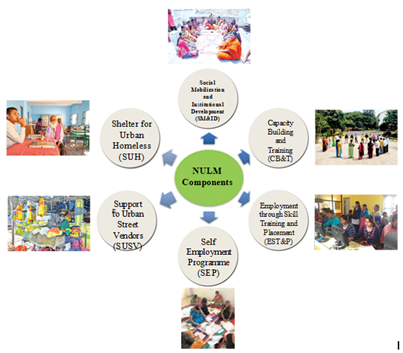

Sub-Schemes under DAY-NULM

- Innovative and Special Projects (ISP): Encourages new approaches to livelihood creation, with up to 5% of total Central Funds allocated for special projects.

- Self-Employment Programme (SEP): Provides financial assistance for self-employment and micro-enterprise development, with loans offered to individuals and SHGs.

- Support for Urban Street Vendors (SUSV): Aims to improve the working conditions of street vendors by offering financial support, training, and developing suitable vending spaces.

- Capacity Building and Training (CBT): Provides training to individuals and agencies involved in urban poverty alleviation to enhance their skills and ability to implement poverty-reduction strategies.

- Social Mobilization and Institution Development (SM&ID): Focuses on empowering the urban poor through the formation of SHGs and federations to improve their access to financial and social services.

- Shelter for Urban Homeless (SUH): Ensures that urban homeless individuals have access to shelters equipped with basic services.

- Employment through Skills Training and Placement (EST&P): Provides training for skill development, helping individuals secure better job opportunities or set up their own businesses.

Benefits of NULM (DAY-NULM)

Financial Benefits:

- Low-Interest Loans: Loans with interest rates as low as 4-7% for SHGs and micro-enterprises.

- Support for Street Vendors: Access to credit, skills, and market development support for vendors.

- Self-Employment Loans: Assistance for urban poor to start their own businesses or micro-enterprises.

Non-Financial Benefits:

- Infrastructure Development for Street Vendors: Provision of designated vending zones with proper infrastructure.

- Shelter for the Homeless: Permanent shelters with essential services.

- Skill Development: Capacity building for better employment and entrepreneurial opportunities.

Pradhan Mantri Jan Dhan Yojana (PMJDY)

Launched:

- Pradhan Mantri Jan Dhan Yojana (PMJDY) was announced on 15th August 2014 and launched on 28th August 2014.

Ministry or Nodal Agency:

- The Ministry of Finance, Government of India is the nodal agency for the implementation of the Pradhan Mantri Jan Dhan Yojana.

Objectives:

- To provide access to financial products & services at an affordable cost.

- To use technology to lower costs and extend the reach of financial services.

- To promote financial inclusion by opening bank accounts for the unbanked population.

Beneficiaries:

- The primary beneficiaries of PMJDY are individuals from economically weaker sections, particularly those who do not have access to formal banking services.

- Persons without any existing bank accounts are eligible to open a basic savings account under PMJDY.

Eligibility Criteria:

- The scheme is available to any individual who does not have a bank account.

- It is open to all Indian citizens, including those from rural and remote areas.

Benefits:

- No Minimum Balance Requirement: No need to maintain a minimum balance in the PMJDY accounts.

- Free Rupay Debit Card: A free RuPay debit card is provided to all account holders.

Accident Insurance Cover:

- Rs. 1 lakh accident insurance cover for existing accounts.

- Rs. 2 lakh accident insurance cover for new accounts opened after 28th August 2018.

Overdraft Facility:

- An overdraft (OD) facility of up to Rs. 10,000 is available to eligible account holders.

DBT Benefits:

- PMJDY accounts are eligible to receive Direct Benefit Transfers (DBT), which include subsidies, welfare payments, and more.

Additional Information:

- PMJDY accounts can be opened at any bank branch or Business Correspondent (Bank Mitra) outlet.

- Interest is earned on the balance in the PMJDY accounts.

- There is no mandatory cheque book facility, but some banks may issue cheque books at their discretion.

- The scheme continues to evolve with the goal of achieving full financial inclusion in the country.

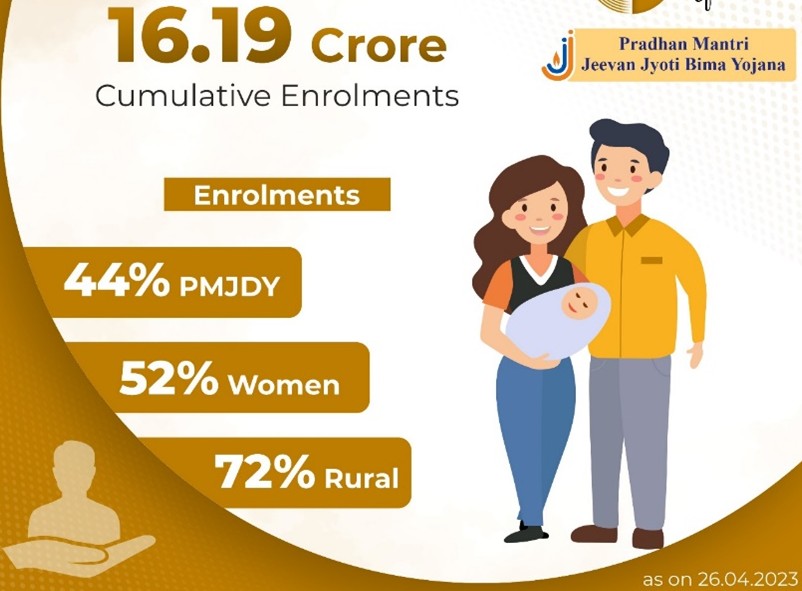

Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY)

Launched:

- May 9, 2015.

Ministry or Nodal Agency:

- Ministry of Finance, Government of India.

- Implementing Agency: Life Insurance Corporation of India (LIC) and other participating private insurance companies.

Objectives:

- To provide life insurance coverage to the poor and vulnerable sections of society.

- To offer affordable life insurance coverage for people aged 18-50 years.

- To ensure financial assistance for families in case of an insured person’s death until an alternative source of income is generated.

- To increase the life insurance penetration in India, as only 20% of the population had insurance coverage as of May 2015.

Beneficiaries:

- The scheme is designed primarily for individuals in the low-income and vulnerable sections of society, including:

- People aged between 18 and 50 years.

- Those who have a savings bank account with a participating bank.

- Those who opt for auto-debit of premiums from their bank accounts.

Eligibility Criteria:

- Age Limit: 18 to 50 years.

- Bank Account: Must have a savings account with any participating bank.

- Health Criteria: Must be in good health and free from critical illnesses as certified at the time of enrollment.

- Aadhar Linkage: It is mandatory for the beneficiary to link their Aadhar card to their bank account for enrollment.

- Consent for Auto-Debit: The subscriber must give consent for auto-debit for premium payment.

- Enrollment Period: Initially, people could enroll from August-November 2015.

- Enrollment is allowed every year during a specific period (from June 1 to May 31) and must be renewed annually to continue coverage.

Benefits:

- Coverage Amount: In case of death of the insured person, the nominee will receive a lump sum amount of Rs. 2 lakhs.

- Premium: The premium is Rs. 330 annually (subject to minor variations for some providers).

- It is auto debited from the savings account.

- Renewability: The coverage is renewed annually, and the subscriber must pay the premium before May 31 for the subsequent year.

- Tax Benefit: Premium paid under PMJJBY qualifies for a tax deduction under Section 80C of the Income Tax Act, 1961.

- No Medical Check-Up Required: There is no requirement for medical examination or health check-up to enroll in the scheme.

- Death Coverage: Provides life coverage for one year from June 1 to May 31.

- If the insured person dies during this period, the Rs. 2 lakh benefit is provided to the nominee.

- Transferable: The policy can be transferred to another bank or post office if the policyholder changes their bank or location.

Additional Information:

- Simple Enrollment Process: Individuals can enroll through any participating bank’s website or mobile app.

- No Maturity Benefits: Since it is a pure term insurance plan, there are no maturity benefits, and it only covers death risk.

- Auto-Debit Facility: The premium is deducted annually via auto-debit from the policyholder’s savings account, making it hassle-free.

- Easy Claims: In case of death, the nominee must submit documents like the death certificate, policy document, and KYC documents to claim the death benefit.

- Risk Coverage: The coverage amount is paid out in case of death due to any reason, including natural or accidental death.

- Investment of Premiums: The premiums collected under PMJJBY are invested in government securities to ensure safety and security of the funds.

-------------------------------------