PREVIOUS

Union Budget 2019-2020 (Part 2)

July 17 , 2019

2096 days

7712

0

Some Basic Infographics

Sector-wise Highlights

Agriculture

- 10,000 new Farmer Producer Organizations to be formed, to ensure economies of scale for farmers.

- Government to work with State Governments to allow farmers to benefit from e-NAM (Electronic National Agricultural Market).

- Zero Budget Farming in which few states’ farmers are already being trained to be replicated in other states.

- The Fertilizer Subsidy allocations have seen a hike of around Rs. 10,000 crores.

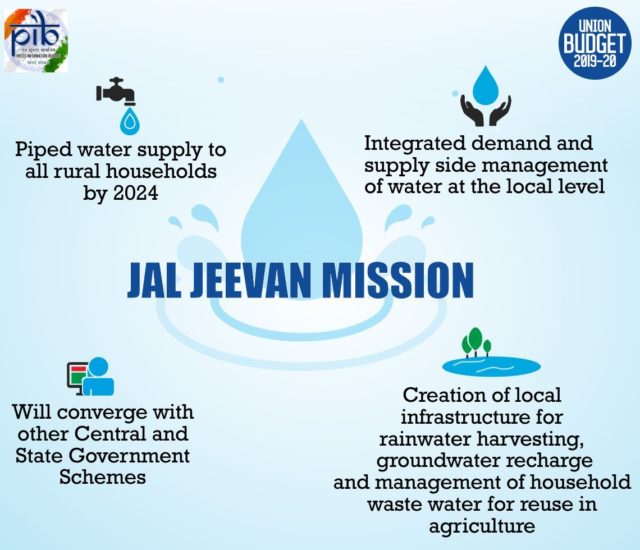

- New Jal Shakti Mantralaya to look at the management of our water resources and water supply in an integrated and holistic manner.

Employment

- 80 Livelihood business incubators and 20 technology business incubators to be set up in 2019-20 under ASPIRE (A Scheme for Promotion of Innovation, Rural Industries and Entrepreneurship) to develop 75,000 skilled entrepreneurs in agro-rural industries.

- Increase focus on skill sets required by the youth to apply for job opportunities abroad like language skills and artificial intelligence.

- It proposes to start a television programme on DD National, exclusively for start-ups.

- This programme will be designed and executed by start-up’s themselves.

- Multiple labour laws to be streamlined into a set of four Labour Codes.

- New-age skills like AI (Artificial Intelligence), Big Data, VR (Virtual Reality), robotics and Internet Of Things (IOT) to be promoted.

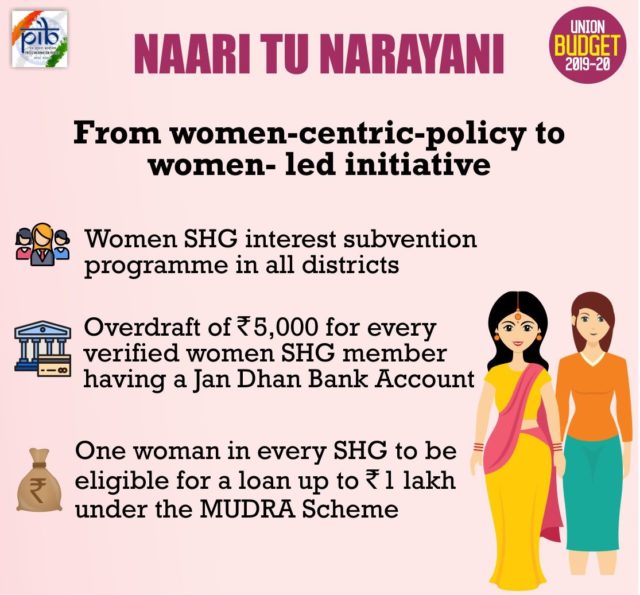

Woman’s empowerment

- To draw attention to the women of India, 'Naari tu Narayaani' scheme will be implemented.

- To further encourage women entrepreneurship, Women Self-help Groups (SHGs) Interest Subvention Programme to be expanded to all districts in India.

- An overdraft of Rs 5,000 will be allowed for every verified woman SHG member having a Jan Dhan account.

- One woman in every SHG shall be made eligible for a loan of 1 lakh rupees under MUDRA scheme.

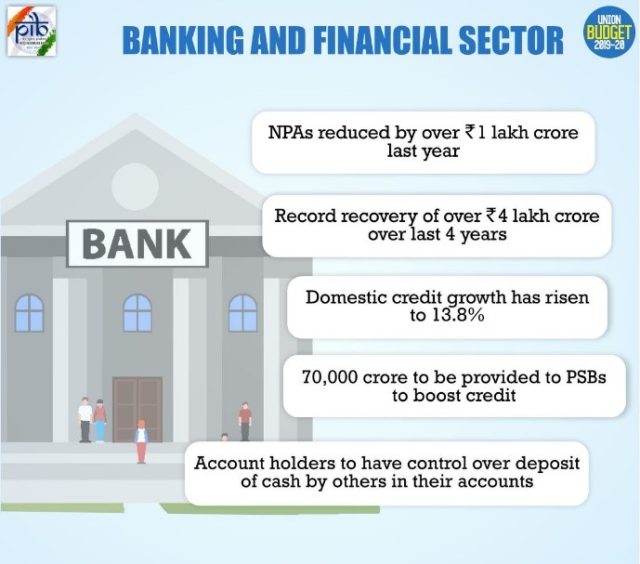

Banks and Financial

- Government is considering to go below 51% to an appropriate level of the ownership stake in non-financial public sector undertakings on a case by case basis.

- Public Sector Banks (PSBs) to be provided Rs 70,000 crore to boost capital and improve credit.

- PSBs will use technology, enabling customer of one PSB to access service across all PSBs as well.

- Proposals for strengthening the regulatory authority of RBI over NBFCs have been made.

- Regulation authority over housing finance sector to be returned from National Housing Bank to RBI.

Foreign Investment

- FDI in sectors like aviation, media, AVGC (Animation, Visual Effects, Gaming, and Comics) and insurance sectors can be opened further after the multi-stakeholder examination.

- Insurance Intermediaries to get 100% FDI.

- Local sourcing norms to be eased for FDI in Single Brand Retail sector.

- Government to organize an annual Global Investors Meet in India, using National Infrastructure Investment Fund (NIIF) as an anchor to get all three sets of global players (pension, insurance and sovereign wealth funds).

- The statutory limit for FPI investment in a company is proposed to be increased from 24% to sectoral foreign investment limit. Option to be given to the concerned corporate to limit it to a lower threshold.

- FPIs to be permitted to subscribe to listed debt securities issued by ReITs (Real Estate Investment Trusts) and InvITs (Infrastructure Investment Trusts).

- NRI-Portfolio Investment Scheme Route is proposed to be merged with the Foreign Portfolio Investment Route.

Railways

- Railway infra would need an investment of 50 lakh crores between 2018 and 2030.

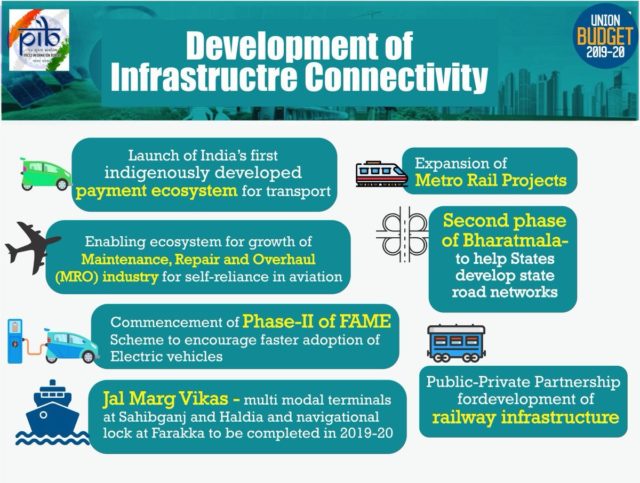

- PPP to be used to unleash faster development and delivery of passenger and freight services.

- Railways to be encouraged to invest more in suburban railways through Special Purpose Vehicles structures such as Rapid Regional Transport System (RRTS).

- More Public-Private Partner (PPP) initiatives to be encouraged in the rail sector.

- A massive programme of railway station modernization to be launched in 2019.

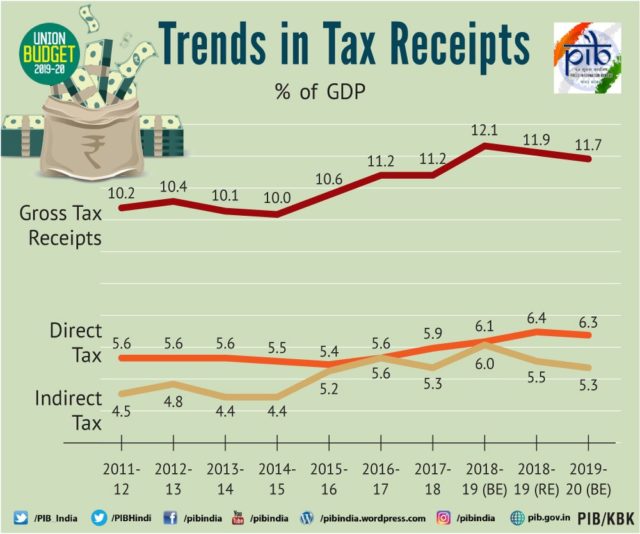

Taxation

- Tax rate reduced to 25% for companies with an annual turnover up to Rs. 400 crores.

- Surcharge increased on individuals having taxable income from Rs. 2 crores to Rs. 5 crore and Rs. 5 crore and above.

- India’s Ease of Doing Business ranking under the category of ‘paying taxes’ jumped from 172 in 2017 to 121 in 2019.

- Direct tax revenue increased by over 78% in the past 5 years to Rs. 11.37 lakh crore.

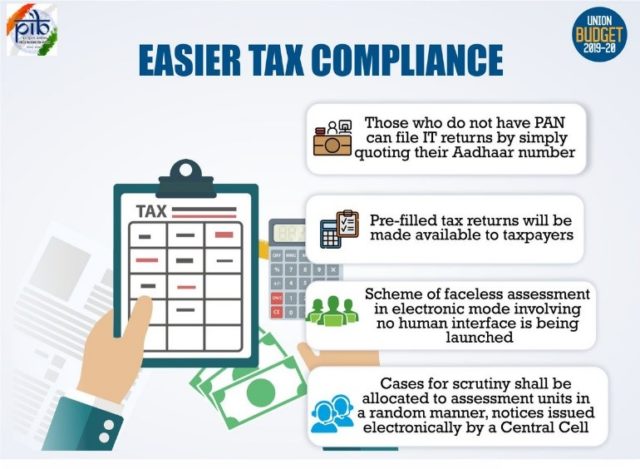

- Interchangeability of PAN and Aadhaar

- Those who don’t have PAN can file tax returns using Aadhaar.

- Aadhaar can be used wherever PAN is required.

Connectivity infrastructure

- National Highway Programme to be restructured to ensure a National Highway Grid, using a financeable model.

- 657 km of the metro rail network has become operational in the country.

- Massive push is given to all forms of physical connectivity through:

- Pradhan Mantri Gram Sadak Yojana,

- Industrial Corridors, Dedicated Freight Corridors,

- Bhartamala and Sagarmala projects, Jal Marg Vikas and UDAN Schemes,

- State road networks to be developed in the second phase of Bharatmala project.

Energy Sector

- Power at affordable rates to states ensured under ‘One Nation, One Grid’.

- Blueprints to be made available for gas grids, water grids, i-ways, and regional airports.

- High-Level Empowered Committee (HLEC) recommendations to be implemented:

- Retirement of old & inefficient plants.

- Addressing the low utilization of gas plant capacity due to paucity of Natural Gas.

- It proposed customs duty reductions on certain raw materials and capital goods needed for nuclear power plants.

- Cross subsidy surcharges, undesirable duties on open access sales or captive generation for industrial and other bulk power consumers to be removed under Ujjwal DISCOM Assurance Yojana (UDAY).

Custom duty

- Basic customs duty on certain items to be increased to promote the cherished goal of Make in India.

- Import of defence equipment not manufactured in India is being exempted from basic customs duty.

- 5% customs duty being imposed on imported books, to promote domestic publishing and printing industry.

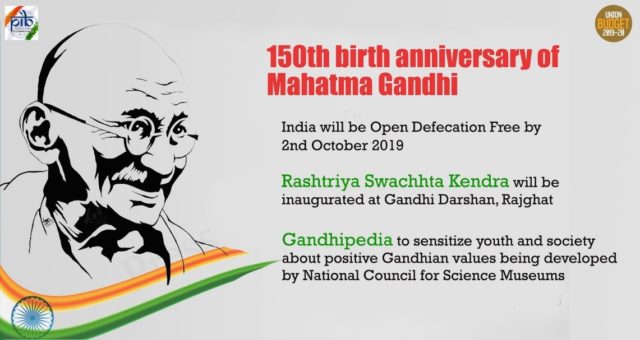

Swachh Bharat Mission

- Proposal to expand Swachh Bharat mission to undertake solid waste management in every village.

- India is to be open defecation free (ODF) by October 2, 2019.

- To mark this occasion, Rashtriya Swachhata Kendra is to be inaugurated at Raj Ghat, on the same day.

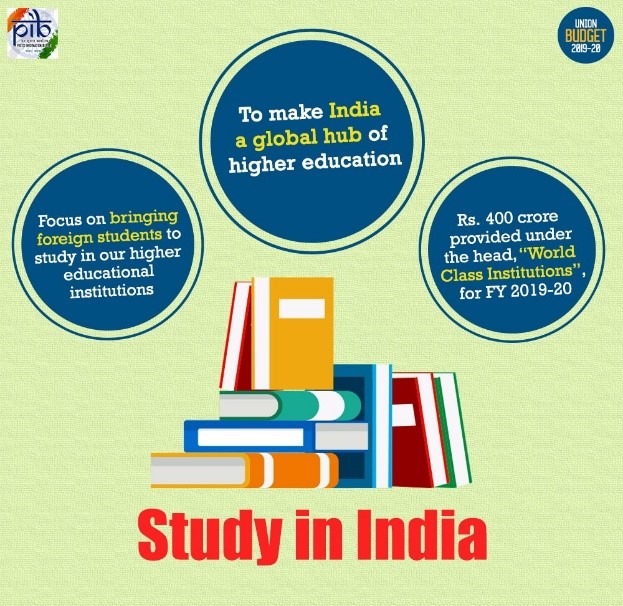

Education and research

- Establish a National Research Foundation (NRF) to fund, to coordinate and to promote research in the country.

- Funds available under all Ministries to be integrated with NRF.

- New National Educational Policy to be brought in to transform the Indian educational system.

- Major changes in higher as well as the school system to be introduced.

- Rs 400 crore under the head, World Class Institutions in 2019-20, more than three times the revised estimates of the previous year.

- 'Study in India' to be started to bring in foreign students into the Indian higher education system.

- The Stand-Up India Scheme which focuses on skill development has been extended up to the year 2025.

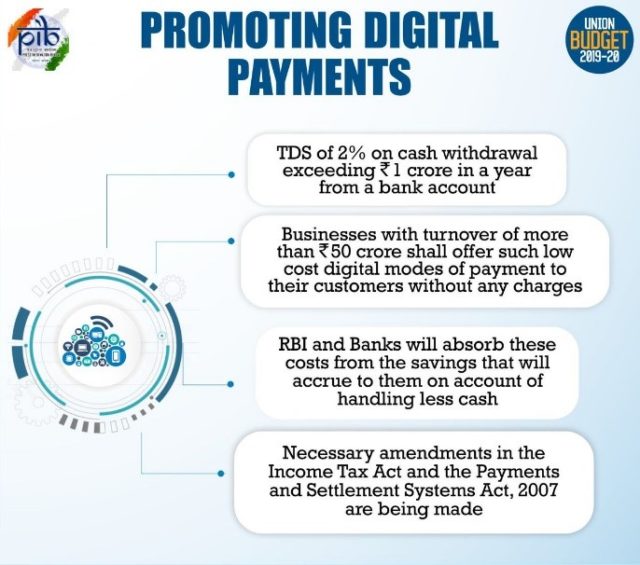

Digital literacy and payment system

- Under Pradhan Mantri Gramin Digital Saksharta Abhiyan, over two crore rural Indians made digitally literate.

- Internet connectivity in local bodies in every Panchayat under Bharat-Net to bridge the rural-urban divide.

- Universal Obligation Fund under a PPP arrangement to be utilized for speeding up Bharat-Net.

- To discourage business payments in cash, Tax Deduction at Source of 2% to be levied on cash withdrawal exceeding Rs 1 crore in a year from a bank account.

- Business establishments with annual turnover of more than 50 crore rupees may offer low-cost digital payments.

- No charges or merchant discount rates to be imposed on customers or merchants for these.

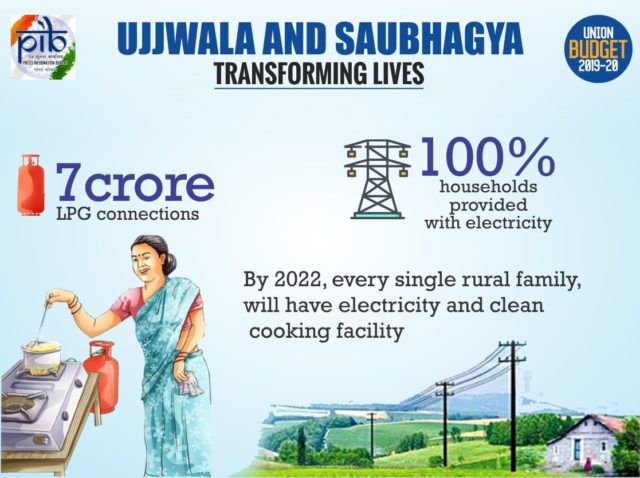

Rural Development

- By 2022, every single rural family except those who are unwilling to take the connection, will have electricity and a clean cooking facility.

- In the second phase of PMAY-Gramin, 1.95 crore houses to be provided to eligible beneficiaries, during 2019-20 to 2021-22.

- Also, they will have amenities such as LPG, electricity, and toilets.

- SFURTI (Scheme of Fund for Regeneration of Traditional Industries) envisions 100 new clusters in 2019-20 to help 50,000 artisans economically.

- Jal Jeevan Mission to achieve Har Ghar Jal (piped water supply) to all rural households by 2024.

Pension

- Pension benefit to be extended to around 3 crore retail traders and shopkeepers with an annual turnover less than Rs 1.5 crore under Pradhan Mantri Karam Yogi Man Dhan Scheme.

- Enrolment to be kept simple, requiring only Aadhaar, bank account, and a self-declaration.

MSME Sector

- Payment platform for MSMEs to be created to enable filing of bills and payment thereof, to eliminate delays in government payments.

Foreign relation

- Aadhaar card for NRIs with Indian passports to be issued after their arrival in India, without waiting for the mandatory 180 days.

- To provide NRIs seamless access to Indian equities, NRI portfolio investment route to be merged with foreign portfolio investment route.

- 18 new Indian diplomatic Missions in Africa approved in March 2018, out of which 5 already opened. Another 4 new Embassies intended in 2019-20.

- Revamp of Indian Development Assistance Scheme (IDEAS) proposed.

- 17 iconic Tourism Sites being developed into model world-class tourist destinations.

- Present digital repository aimed at preserving rich tribal cultural heritage, to be strengthened.

Space Sector

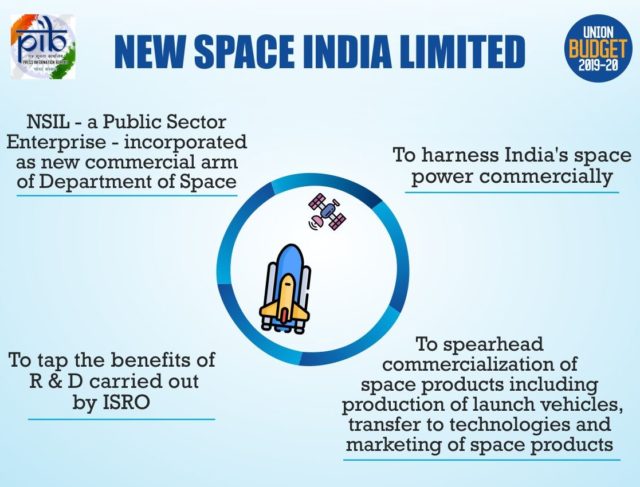

- New Space India Limited (NSIL), a PSE, incorporated as a new commercial arm of Department of Space.

- To tap the benefits of the Research & Development carried out by ISRO like the commercialization of products like launch vehicles, transfer to technologies and marketing of space products.

Electric Vehicles

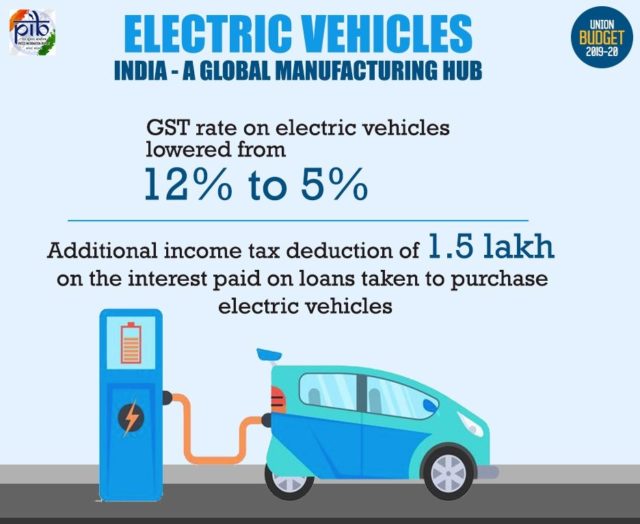

- Government has already moved GST council to lower the GST rate on electric vehicles (EV) from 12% to 5%.

- The government will provide Rs 1.5 lakh income tax deduction on interest payments on the loan taken for the purchase of electric vehicles.

- FAME II scheme aims to encourage faster adoption of electric vehicles by the right incentives and charging infrastructure.

- Customs duty on certain parts of electric vehicles being exempted to promote e-mobility.

- - - - - - - - - - - - - - -

Leave a Reply

Your Comment is awaiting moderation.