PREVIOUS

Union Budget 2019-2020 (Part 1)

July 9 , 2019

2115 days

3214

0

- Union Finance Minister Nirmala Sitharaman presented her maiden Budget in Lok Sabha on 05 July 2019.

- This is the 89th Union Budget of the Union government.

- It has the details of revenue and expenditure in the past, as well as estimated spending and projections for the coming year.

- This first Budget of Narendra Modi government's second tenure is the maiden one for Nirmaala Sitharaman.

- She is the Second woman finance minister of India after Indira Gandhi in 1970.

- But she is the first full time Women finance minister of India.

- For the first time the budget document was carried out in a Red Cloth bag rather than Conventional Leather Briefcase.

- For the first time, the Finance Minister skipped reading the allocations to different Ministries, or the macroeconomic numbers like projected revenues or expenditure.

- She did inform the Lok Sabha that all the numbers had been mentioned in the annexure of the Budget document.

Ten points of our Vision:

- India’s 10 point ‘Vision for the Decade’ was flagged in Budget 2019.

- Gaon, Garib and Kisan [village, poor, and farmer] is at the centre of all policies of this government.

- Building physical and social infrastructure;

- Digital India reaching every sector of the economy;

- Pollution free India with green Mother Earth and Blue Skies;

- Make in India with particular emphasis on MSMEs, Start-ups, defence manufacturing, automobiles, electronics, fabs and batteries, and medical devices;

- Water, water management, clean Rivers;

- Blue Economy;

- Space programmes, Gaganyan, Chandrayan and Satellite programmes;

- Self-sufficiency and export of food-grains, pulses, oilseeds, fruits and vegetables;

- Healthy society – Ayushman Bharat, well-nourished women & children. Safety of citizens;

- Team India with Jan Bhagidari - Minimum Government Maximum Governance.

Top Announcements

- India will become $5 trillion economy goal by 2024.

- The Indian economy will grow to become a 3 trillion-dollar economy in the current year.

- ₹70,000 crore in recapitalisation for public sector banks.

- ₹05 lakh crore disinvestment target for the year.

- Budget proposed to enhance surcharge on individual income of Rs 2-5 crore and over Rs 5 crore by 3% and 7% respectively.

- Custom duty on gold and other precious metals from 10% to 12.5% has been proposed.

- To provide further impetus to affordable housing, additional deduction of Rs 1.5 lakh on interest paid on loans borrowed up to March 31, 2020 for purchase of house up to Rs 45 lakhs.

- Overall benefit of around Rs. 7 lakhs over loan period of 15 years.

- Road and infrastructure cess on diesel and petrol to be increased by Re 1/litre.

- Special Additional Excise duty on Petrol and Diesel will be hiked by Re 1/litre.

- Government has already moved GST council to lower the GST rate on electric vehicles from 12% to 5%.

- Fiscal deficit in 2019 will be 3.3%, brought down from 3.4%.

- All companies having annual turnover of 400 crores, will now be under the bracket of 25% corporate tax rate. This will cover 99.3% of all the companies.

- India’s sovereign external debt to GDP is among the lowest globally at less than 5%.

- Electricity and clean cooking facility to all willing rural families by 2022.

- To mark the 150th Birth Anniversary of Gandhi, the Rashtriya Swachhta Kendra to be inaugurated at Gandhi Darshan, Rajghat on 2nd October, 2019.

- Gandhipedia is being developed by National Council for Science Museums to sensitize youth and society about positive Gandhian values.

Highlights of the Union Budget

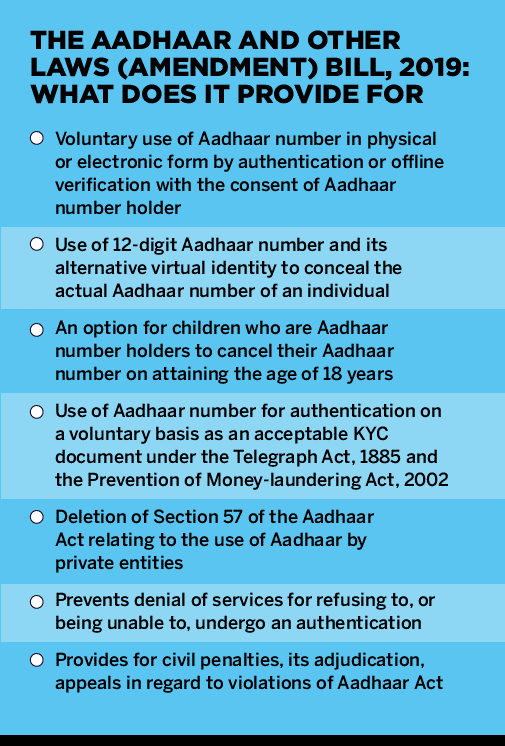

- PAN and Aadhaar will become interchangeable. People can use your Aadhaar number to file your I-T Returns soon.

- ₹5 lakh minimum limit was already announced for taxpayers.

- GST rate on electric vehicles proposed to be lowered to 5%.

- Additional income tax deduction of ₹5 lakh on interest paid on loans taken to purchase electric vehicles.

- Proposal to provide Aadhaar cards for NRIs with Indian passports, after their arrival in India, with no waiting period.

- ₹20 coin is coming up.

- To resolve the angel tax issue, startups will not be subject to any scrutiny in respect to valuation.

- Funds raised by startups will not require any scrutiny by the I-T department.

- TDS of 2% on cash withdrawals exceeding ₹1 crore in a year from bank accounts, to discourage business payments in cash.

- Period of exemption for capital gains arising from sale of house for investment in startups to be extended to March 31, 2021.

- TV channel to be launched for promoting startups and to help matchmaking for funds.

- New national educational policy hopes to transform Indian education into one of the best in the world, with focus on bringing in foreign students.

- ₹50 lakh crores proposed for Railway infrastructure.

- By 2022, the 75th year of Independence, every single rural family, except those who are unwilling to take the connection, will have electricity and clean cooking facility.

- Stress on zero-budget farming, which is a form of gardening as a self-sustainable practice, with minimum external intervention.

- The pension benefit will be extended to 3 crore retail traders under PM Karam Yogi Maan Dhan Scheme.

- ₹1 crore worth of loans proposed to MSMEs.

- Investment by FIIs and FDIs in debt securities in infrastructure debt funds to be allowed.

- Minimum public shareholding in listed companies can be increased from 25% to 35%.

- Global Investors Meet will be held in India.

- Creating an electronic fund-raising platform – a social stock exchange - under the regulatory ambit of Securities and Exchange Board of India (SEBI) for listing social enterprises and voluntary organizations.

- 100% Foreign Direct Investment (FDI) will be permitted for insurance intermediaries.

- Through a focused Scheme – the Pradhan Mantri Matsya Sampada Yojana (PMMSY) – the Department of Fisheries will establish a robust fisheries management framework.

- National Sports Education Board for development of sportspersons to be set up under Khelo India, to popularize sports at all levels.

- Model Tenancy Law to be finalized and circulated to the states.

- Credit Guarantee Enhancement Corporation to be set up in 2019-2020.

- Statutory limit for FPI investment in a company is proposed to be increased from 24% to sectoral foreign investment limit.

- NRI-Portfolio Investment Scheme Route is proposed to be merged with the Foreign Portfolio Investment Route.

Achievements during 2014-19

- 1 trillion dollars added to Indian economy over last 5 years (compared to over 55 years taken to reach the first trillion dollar).

- From 1.85 trillion dollars in 2014, the economy has reached 2.7 trillion US dollars

- India is now the 6th largest economy in the world, compared to 11th largest five years ago.

- Indian economy is globally the 3rd largest in Purchasing Power Parity (PPP) terms only next to China and the USA.

- Strident commitment to fiscal discipline and a rejuvenated Centre-State dynamic provided during 2014-19.

- Structural reforms in indirect taxation, bankruptcy and real estate carried out.

- Average amount spent on food security per year almost doubled during 2014-19 compared to 2009-14.

- Patents issued more than trebled in 2017-18 as against the number in 2014.

- Ball set rolling for a New India, planned and assisted by the NITI Aayog.

Roadmap for future

- Simplification of procedures.

- Incentivizing performance.

- Red-tape reduction.

- Making the best use of technology.

- Accelerating mega programmes and services initiated and delivered so far.

- - - - - - - - - - - - - -

Leave a Reply

Your Comment is awaiting moderation.