PREVIOUS

Finances of Panchayat Raj Institutions

January 31 , 2024

454 days

976

0

- The Reserve Bank of India’s (RBI) maiden report on ‘Finances of Panchayati Raj Institutions’ was released.

- The PRIs need to intensify efforts to augment their own tax and non-tax revenue resources and improve governance.

- Around 95% of the PRI revenues are in the form of grants from the Centre and states.

- It is restricting their spending ability that is already hampered by delays in the constitution of State Finance Commissions.

- The average revenue per Panchayat from all sources – taxes, non-taxes and grants – was Rs 2.12 million in 2020-21, Rs 2.32 million in 2021- 22 and Rs 2.12 million in 2022-23.

- The decline in 2022-23 was owing to lesser devolution of grants.

- The own revenues of the Panchayats were only 1.1% of their total revenue.

- It is generated by imposing local taxes, fees, and charges on various activities, including land revenue, professional and trade taxes, and miscellaneous fees.

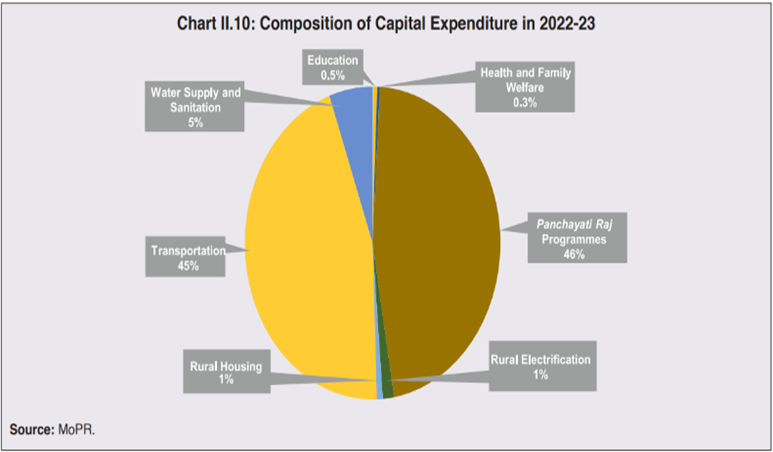

- Non-tax revenue – primarily from Panchayati Raj programmes and interest earnings – is also modest, with a share of only 3.3% of their total revenue receipts.

- Panchayats in Tamil Nadu, Himachal Pradesh, Maharashtra, and Telangana have reported higher non-tax revenue than other states.

- The average expenditure per Panchayat was decreased from Rs 17.3 lakh in 2020-21 to Rs 12.5 lakh in 2022-23.

- This was due to higher than-normal spending in the pandemic year 2020-21.

- Goa, Karnataka, Odisha, Sikkim, Kerala, and Tamil Nadu recorded the highest average expenditure at the Panchayat level.

- The ratio of revenue expenditure of Panchayats to nominal GSDP is less than 0.6 percent for all the States.

- It was ranging from 0.001 percent in Bihar to 0.56 percent in Odisha.

Leave a Reply

Your Comment is awaiting moderation.