PREVIOUS

GST compensation Cess 2024

October 5 , 2024

47 days

226

0

- The Goods and Services Tax (GST) Council has set up a 10-member GoM, chaired by Minister of State for Finance Pankaj Chaudhary.

- It is tasked to decide on the taxation of luxury, sin and demerit goods once the compensation Cess ends in March 2026.

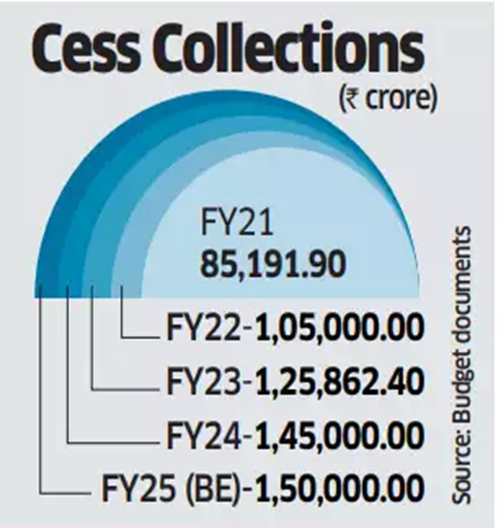

- In the GST regime, compensation cess at varied rates is levied on luxury, sin and demerit goods over and above the 28% tax.

- The proceeds from the cess were originally planned for five years after GST roll-out or till June 2022.

- This cess is used to compensate States for revenue loss incurred by them post the introduction of GST.

- In 2022, the Council decided to extend the levy till March 2026.

- Currently, GST is a four-tier tax structure with slabs at 5, 12, 18, and 28%.

- However, as per GST law, tax of up to 40% can be imposed on goods and services.

Leave a Reply

Your Comment is awaiting moderation.