PREVIOUS

Guidelines for Licencing of Small Finance Banks

December 12 , 2019

1956 days

1592

0

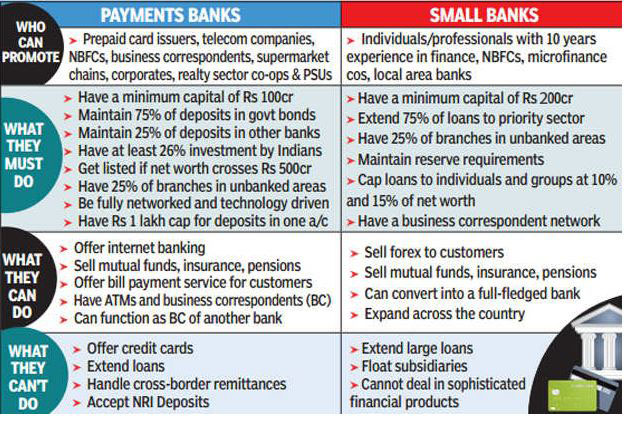

- Reserve Bank of India has released final Guidelines for ‘on tap’ Licencing for Small Finance Banks (SFBs).

- RBI had issued in-principle approval to ten applicants for SFB in 2015.

- An “on-tap” facility would mean the RBI will accept applications and grant licences for banks throughout the year.

Guidelines

- Capital requirement: The minimum paid-up voting equity capital / net worth requirement shall be ₹ 200 crores.

- Scheduled bank status to SFBs: SFBs will be given scheduled bank status immediately upon commencement of operations.

- Payments Banks conversion to SFBs: The payment banks can apply for conversion into SFB after 5 years of operations.

Leave a Reply

Your Comment is awaiting moderation.