PREVIOUS

Indexation on LTCG 2024

August 4 , 2024

112 days

231

0

- The new LTCG regime proposed in the Union Budget does away with the indexation benefit available for calculation of LTCG on property, gold, and other unlisted assets.

- It reduced the long-term capital gains (LTCG) tax rate to 12.5% from 20%.

- It stated that this was to “ease computation of capital gains for the taxpayer and tax administration”.

- For properties and other assets purchased prior to 2001, the fair market value as on April 1, 2001 would be considered as the cost of acquisition.

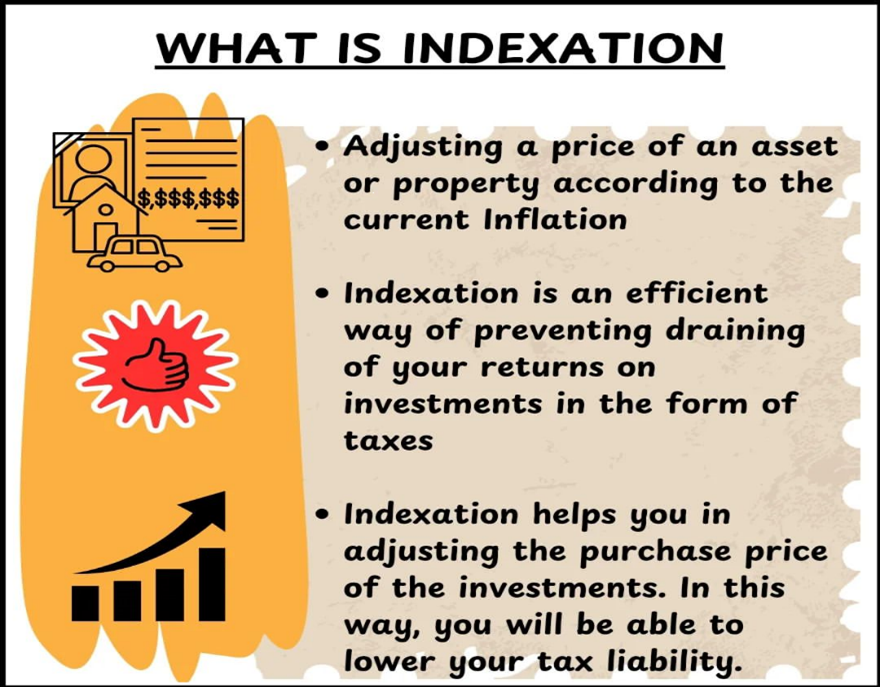

- Indexation is the process of adjusting the original purchase price of an asset or investment in order to neutralise the impact of inflation on it.

- It involves revising upward the cost of acquisition of an asset based on the inflation over the period for which it was held.

Leave a Reply

Your Comment is awaiting moderation.