PREVIOUS

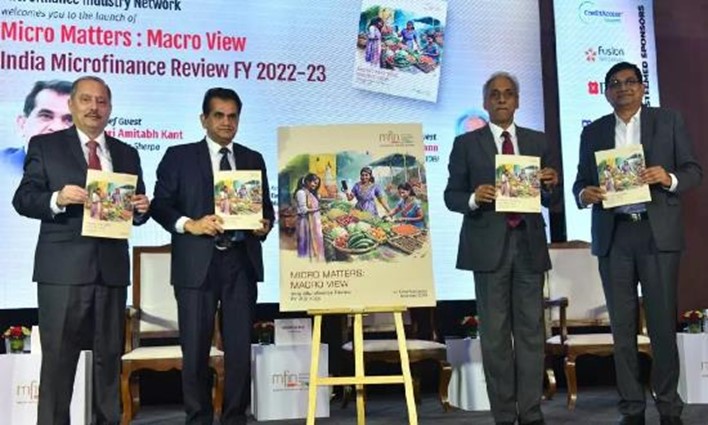

India Microfinance Review FY 2022-23

November 23 , 2023

522 days

751

0

- The report is the third edition of Micro Matters: Macro View, a report conceived in 2021 to provide a holistic view of the sector.

- India could hold its ground and grow by 7% in 2022-23.

- The share of micro under MSME credit by Scheduled commercial banks has risen to 17.9% by March 2023.

- Insurance penetration is now 4.2% of GDP and bank account ownership is now ubiquitous with no gender gap.

- Microfinance sector (NBFC-MFIs, Banks, SFBs and NBFC) added 87 lakh new women clients during 22-23.

- Its credit outstanding reaching 3.48 lakh crore across 729 districts to 6.64 crore low-income women clients.

Leave a Reply

Your Comment is awaiting moderation.