PREVIOUS

Interest rate by RBI

June 10 , 2022

975 days

747

0

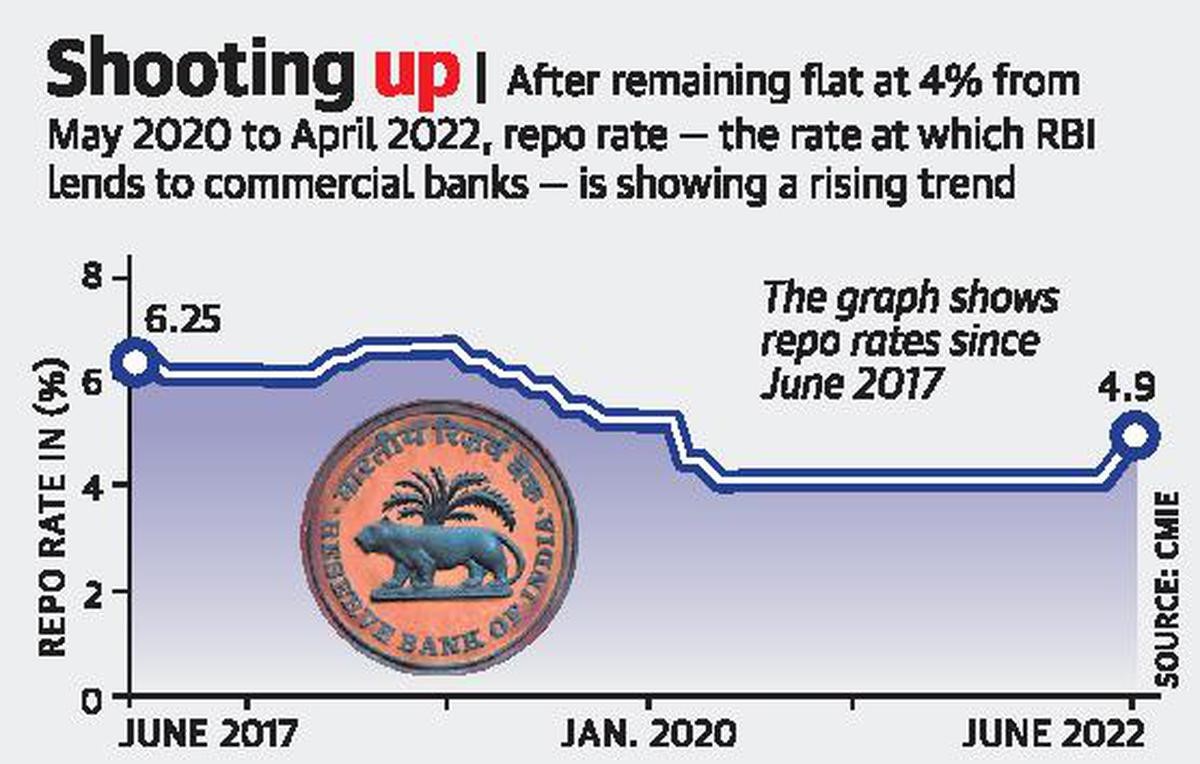

- The Reserve Bank of India’s Monetary Policy Committee (MPC) voted unanimously to raise the repo rate by 50 basis points to 4.90%.

- In May 2022, RBI increased the repo rate or short-term lending rate by 40 basis points

- The RBI’s move will increase borrowing costs for those seeking loans to buy cars and homes and MSME firms looking to raise capital.

- The MPC also decided to remain focused on the withdrawal of accommodation which had been provided to support the COVID-19 hit economy.

- It aims to ensure that inflation remains within the target going forward, while supporting growth

- The MPC fix the benchmark interest rates in India.

- The committee held at least 4 times a year.

- The Governor of RBI act as the chairperson ex officio of MPC.

Leave a Reply

Your Comment is awaiting moderation.