PREVIOUS

LCR maintenance

January 16 , 2022

1444 days

1271

0

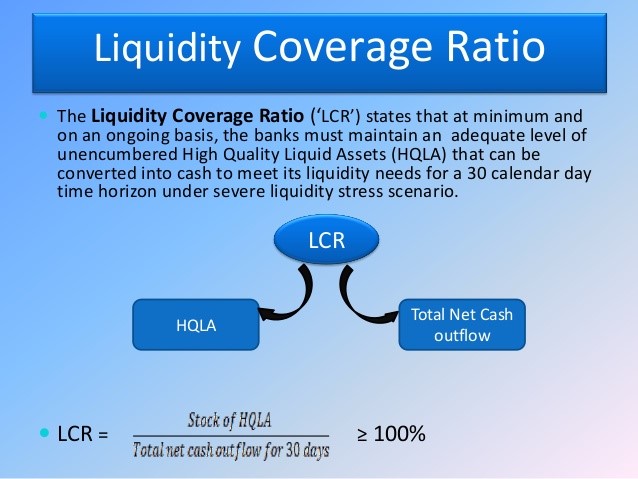

- The Reserve Bank of India has increased the threshold limit for Banks to maintain the Liquidity Coverage Ratio (LCR).

- It will be on deposits and other ‘extension of funds’ received from non-financial small business customers from Rs 5 crore to Rs 7.5 crore.

- This is applicable on all Commercial Banks other than Regional Rural Banks, Local Area Banks, and Payments Banks.

- It is to align RBI’s guidelines with the Basel Committee on Banking Supervision (BCBS) standard and enable banks to manage liquidity risk more effectively.

- LCR promotes the short-term resilience of banks to potential liquidity disruptions.

- It will ensure that they have sufficient high-quality liquid assets (HQLAs) to survive an acute stress scenario lasting for 30 days.

Leave a Reply

Your Comment is awaiting moderation.