PREVIOUS

RBI’s 29th Financial Stability Report

July 8 , 2024

291 days

467

0

- Capital to risk-weighted assets ratio (CRAR) and the common equity tier 1 (CET1) ratio of scheduled commercial banks (SCBs) had stood at 16.8% and 13.9%, respectively, at end-March 2024.

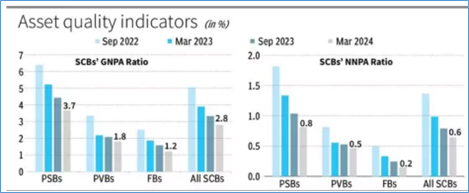

- SCBs’ gross non-performing assets (GNPA) ratio fell to a multi-year low of 2.8 per cent.

- Their net non-performing assets (NNPA) ratio fell to 0.6 per cent at end-March 2024.

- Non-banking financial companies (NBFCs) remain healthy, with CRAR at 26.6 per cent, GNPA ratio at 4.0% and return on assets (RoA) at 3.3%, respectively.

- CRAR is a measure of a bank’s financial strength.

- A CRAR of 16.8% means that for every 100 units of risk, the bank has 16.8 units of capital to cover potential losses.

- GNPA Ratio measures the percentage of a bank’s loans that are not being repaid.

Leave a Reply

Your Comment is awaiting moderation.