PREVIOUS

Silicon Valley Bank Collapse

March 18 , 2023

1004 days

1057

0

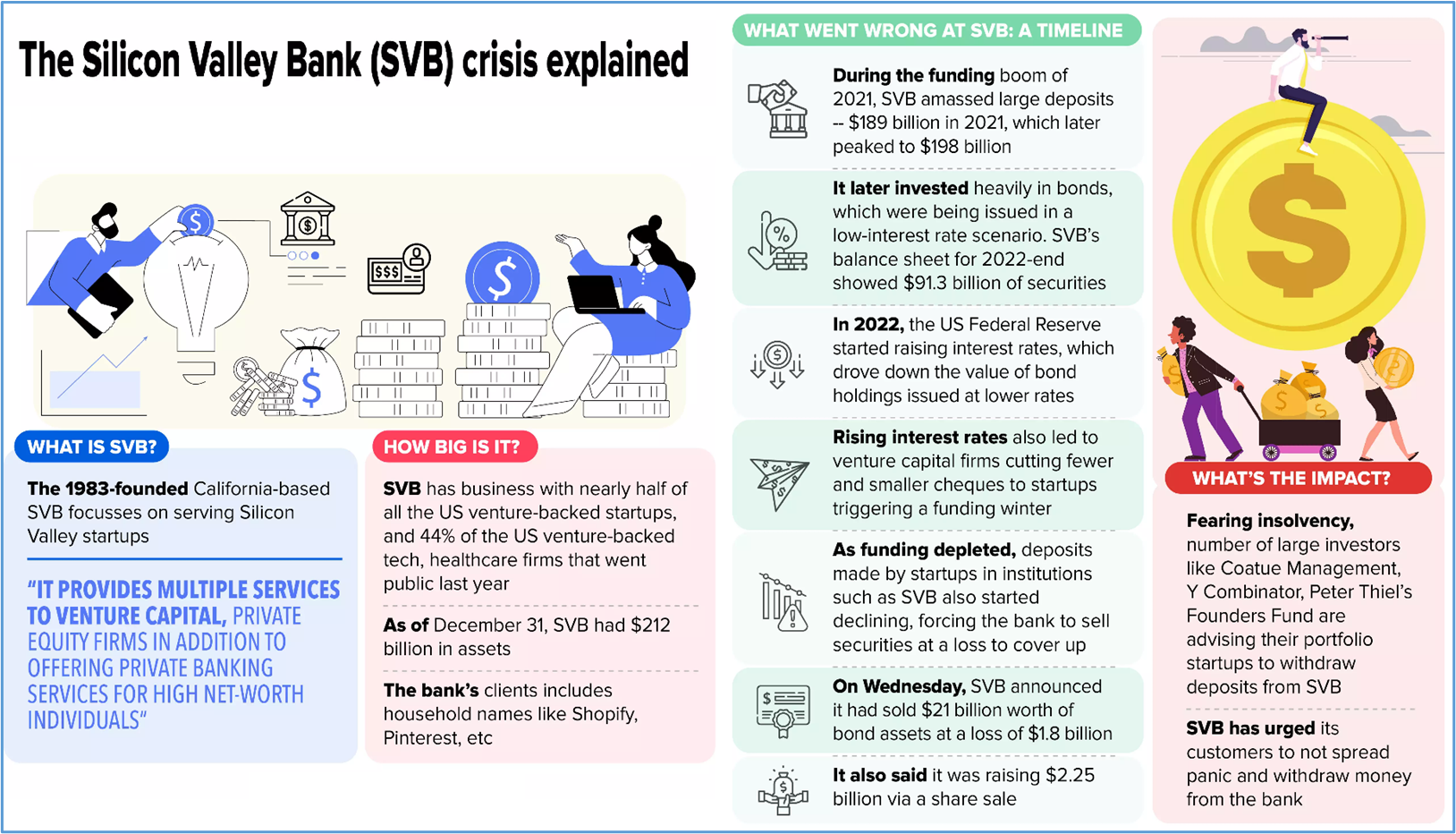

- The Silicon Valley Bank was closed by California banking regulators of USA.

- This is the biggest retail banking failure since the global financial crisis in 2008.

- US regulators shuttered Silicon Valley Bank (SVB) and took control of its deposits.

- Silicon Valley Bank is known for lending money to some of the biggest technology startups.

- Silicon Valley Bank invested most of its assets in US bonds.

- To bring down the inflation rates, the federal reserve last year began raising interest rates, which resulted in the bond values going down.

- It had lost nearly $2 billion.

- After the bank's closure, nearly $175 billion of customer deposits are now under the control of the Federal Deposit Insurance Corporation (FDIC).

- The FDIC has created a new bank, the National Bank of Santa Clara.

- That will now hold all the assets of Silicon Valley Bank.

Leave a Reply

Your Comment is awaiting moderation.