PREVIOUS

Ways and Means Advances

April 3 , 2020

2088 days

2241

0

- The Reserve Bank of India has raised the limit for short term credit that the government can borrow from the central bank.

- The limits for this credit facility, known as ‘Ways and Means Advances’, has been raised sharply to Rs 1.2 lakh crore for the first half of 2020-21.

- The increased limit comes at a time when government expenditure is expected to rise as it battles the fallout of a spreading Coronavirus.

- The availability of these funds will give government some room to undertake short term expenditure over and above its long term market borrowings.

About Ways and Means Advances (WMA)

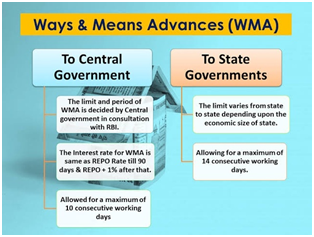

- They are temporary loan facilities provided by RBI to the government to enable it to meet temporary mismatches between revenue and expenditure.

- It was introduced on April 1, 1997, after putting an end to the four-decade old system of adhoc or temporary Treasury Bills to finance the Central Government deficit.

- The government can avail of immediate cash from the RBI, if required.

- But it has to return the amount within 90 days, and the Interest is charged at the existing repo rate.

- The limits for WMA are mutually decided by the RBI and the Government of India.

- There are two types of Ways and Means Advances — normal and special.

- Special WMA or Special Drawing Facility (SDF) is provided against the collateral of the government securities held by the state.

- After the state has exhausted the limit of SDF, it gets normal WMA.

Leave a Reply

Your Comment is awaiting moderation.